tl;dr

Heard you’ll make less if you get a raise? That’s a myth. Yes, you may enter a higher tax bracket, but only part of your income gets taxed at the higher rate. You’ll still take home more. Take that raise and celebrate.

What You’ve Heard

We’ve seen more than a couple comments on social media about people proudly turning down a promotion because the taxes would eat away the extra money. We shed a tear each time.

It sounds believable because we have “tax brackets” in the US which means people at different income levels have to pay varying percentages of their incomes. But there’s an important twist which we’ll explain below.

So What Are Taxes, Anyway?

You’ll probably see a few different types of taxes on your paycheck — often in the form of cryptic letter codes. The main ones:

- Federal Income tax: This is the big one. It’s progressive and marginal, meaning the more you earn, the more you pay on the extra. (More on that below.)

- State income tax: Varies by state. Some have none, some charge a flat rate, and others have their own brackets. Usually between 2–10%.

- Social Security and Medicare: 6.2% of your pay goes toward Social Security and 1.45% goes to Medicare. There’s light at the end of the tunnel: in theory you’ll take advantage of these benefits in your old age. Plus, Social Security stops getting taken out of your check once you’ve made $176,000 (meaning you’ve already paid $176,000 * 6.2%, or almost $11,000 for the year!) Does it make you feel better that your employer has to pay some too?

If you’re quite unlucky, you might have other types like a city-imposed tax, but these tend to be much smaller.

Taxes In Action (aka Math Time)

Your exact “tax bracket” depends on how much money you make, and whether you’re single and married. You can actually look up the entire list of tax brackets for this year on the IRS website.

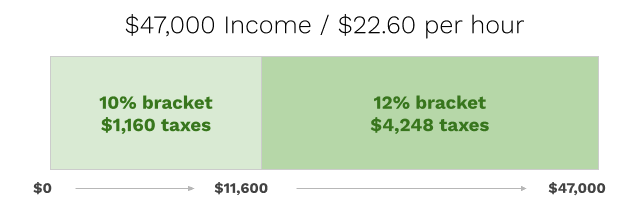

For a single person making $47,000 per year, you’d be in the 12% tax bracket this year. So are you paying $47,000 * 12% total? Nope. Here’s how it really breaks down:

You’d end up paying around $5400 in federal taxes, or 11.5% overall. That’s right — you only pay the higher percentage on the portion of your income that falls within that bracket.

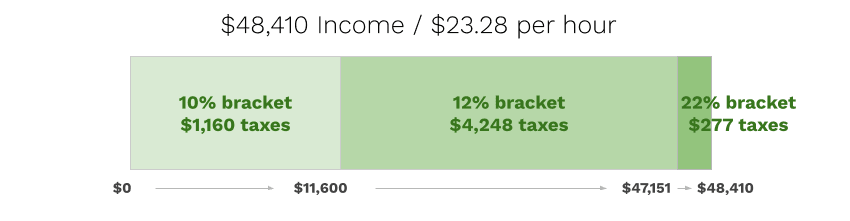

Here’s what it really looks like if you got a very generous 3% raise that bumps you up to the 22%! bracket:

You pay $126 more than would have at the lower tax bracket… but you still walk away with $1,133 more than you had before. That new 22% tax bracket can’t touch the money from the 10% and 12% tiers.

Common Confusions And Gotchas

Taxes are still pretty complex. There could be specific, individual cases where a higher income causes somebody to be disqualified for some kind of benefit like a tax credit with an income cap, or income-based repayment for your student loan. But that’s a separate issue related to eligibility for programs, not how tax brackets work. If you have any sort of income-based benefit it’s always good to read the fine print to understand it fully.

Also, your paycheck withholding is just an estimate. That’s why you file taxes every year – to balance everything out. Some situations that can throw it out of whack:

- Getting a big one-time bonus (the system assumes you’ll earn that much every pay period)

- Working multiple jobs (each job doesn’t “see” the other’s income)

- Freelance or gig work with no taxes withheld — you’ll need to pay those yourself later

You may feel a little confused. If this is how taxes work, then why do some people always say rich people should pay more when they already do? Well, the argument is that the rates should be even higher as you go up the tax brackets. A dollar doesn’t have quite the same value to a person with $1 million income versus someone with an hourly paycheck.

What To Do

Don’t turn down the raise. A promotion is recognition of your work and usually raises your baseline for future pay, too.

Stay aware of your finances and understand what’s coming out of your check. Helpful tools:

- Paycheck calculator to help estimate how much you’ll take home

- W4 Calculator to help you configure the taxes coming out of your check as best as possible. Pro tip: you can update your W4 anytime, not just when you start a job. Talk to your HR team or check your employee portal.

- Finally, for special cases or specific questions you can always seek out an actual tax professional. Or throw a question in our Group Chat.

Take the raise. File your taxes. Keep leveling up. You’ve got this.